One company on our list stands out for the infamous role its executives played in the 2008 financial crisis: American International Group. Back then, the insurance giant ignited a firestorm by pocketing a $180 billion taxpayer bailout and then announcing plans to hand out $165 million in bonuses to the very same executives responsible for pushing the company — and the nation — to the brink of collapse.

Today, AIG is playing the same greedy game of overpaying its top brass and sticking taxpayers with the bill. Between 2018 and 2022, the company paid its top five executives more than it paid in federal income taxes, despite collecting $17.7 billion in U.S. profits. In 2022, CEO Peter Zaffino alone made $75 million.

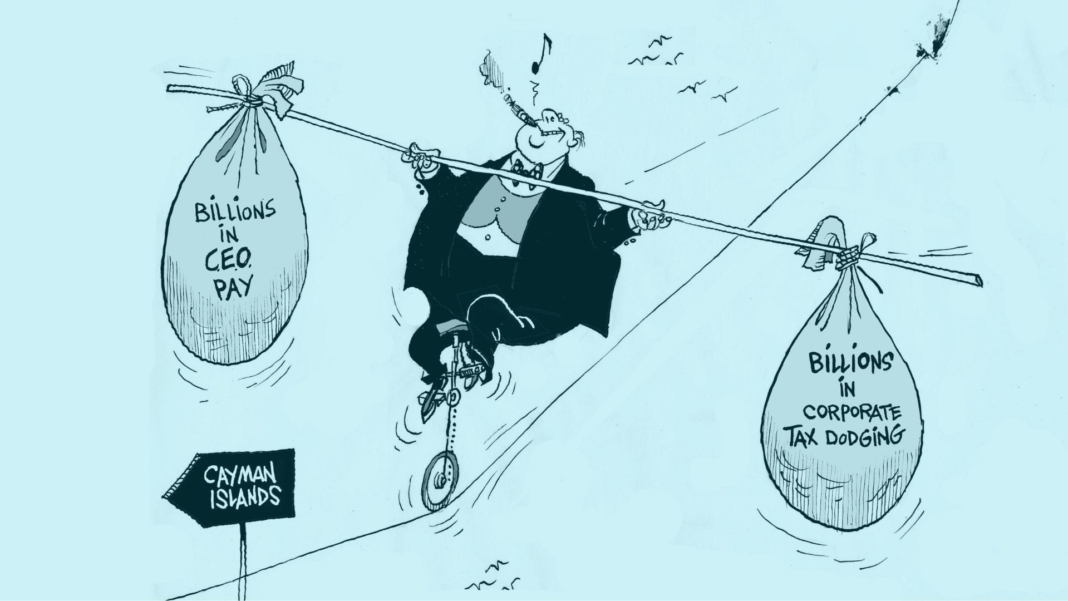

Lavish executive compensation packages and skimpy corporate tax payments are not unrelated phenomena. Executives have a huge personal incentive to hire armies of lobbyists to push for corporate tax cuts because the windfalls from these cuts often wind up in their own pockets.

The 2017 Republican tax law slashed the corporate tax rate from 35 percent to 21 percent and failed to close loopholes that whittle down IRS bills even further. Many large, profitable corporations ended up paying no federal taxes at all.

Corporations took the savings from those tax cuts and spent a record-breaking $1 trillion on stock buybacks, a financial maneuver that artificially inflates the value of executives’ stock-based pay.

Wealthy executives became even wealthier while the nation lost billions of dollars in corporate revenue that could have been used to lower costs and improve services for ordinary people. Until this self-reinforcing cycle is broken, we’ll have a corporate tax and compensation system that works for top executives — and no one else.

Source: inequality.org