Higher inflation and rising wages suggest that the country’s economy can grow without such aggressive stimulus from the central bank.

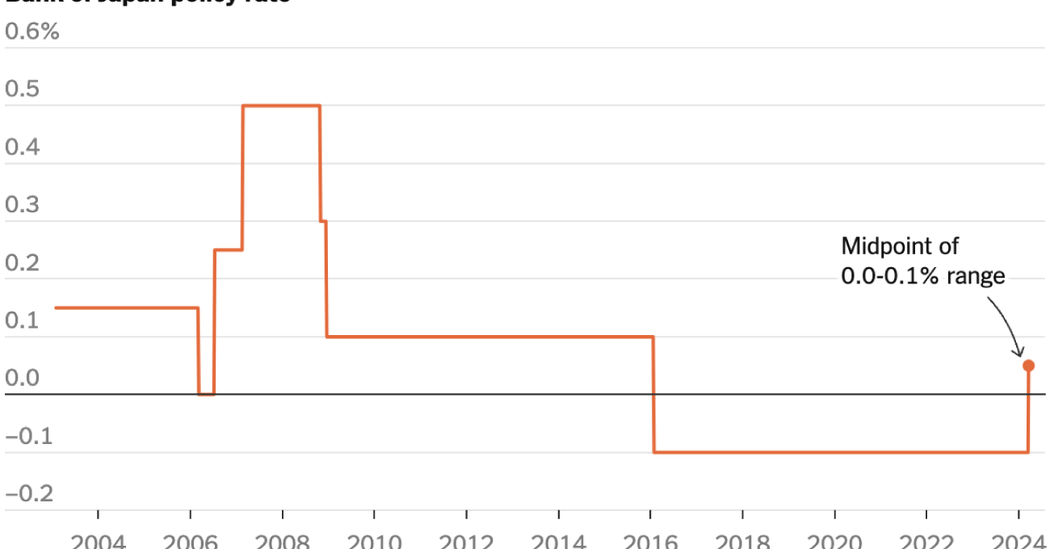

Japan’s central bank raised interest rates for the first time since 2007 on Tuesday, pushing them above zero to close a chapter in its aggressive effort to stimulate an economy that has long struggled to grow.

In 2016, the Bank of Japan took the unorthodox step of bringing borrowing costs below zero, a bid to kick-start borrowing and lending and spur the country’s stagnating economy. Negative interest rates — which central banks in some European economies have also applied — mean depositors pay to leave their money with a bank, an incentive for them to spend it instead.

But Japan’s economy has recently begun to show signs of stronger growth: Inflation, after being low for years, has sped up, cemented by larger-than-usual increases in wages. Both are clues that the economy may be on a course for more sustained growth, allowing the central bank to tighten its interest rate policy years after other major central banks raised rates rapidly in response to a jump in inflation.

Even after Tuesday’s move, interest rates in Japan are far from those in the world’s other major developed economies. The Bank of Japan’s target policy rate was raised to a range of zero to 0.1 percent from minus 0.1 percent.

The bank, in a statement Tuesday, said it had concluded that the economy was in a “virtuous cycle” between wages and prices, meaning that wages were rising enough to cover increasing prices but not so much as to cut into business profits. The main inflation reading in Japan was 2.2 percent in January, the most recent data available.

The central bank also scrapped a policy in which it bought Japanese government bonds to keep a lid on how high market rates can go, encouraging businesses and households to borrow cheaply. The bank had been slowly relaxing the policy over the past year, resulting in higher yields on debt as the country’s growth prospects improved.

Source: nytimes.com